The US Playbook to Win the Mineral Cold War

What seems to be a confused flurry is a sophisticated strategy

👋 Welcome to A World Reconfigured - your guide to a world changed by climate, geopolitics and technology. I write about how climate change is creating a new world with new rules, and often cover topics like the ❄️Arctic, 🤷♂️Rare Earths and 💻Data Centers.

A new cold war has emerged - not about satellites, data centers of even AI chips. It’s about the minerals that enable our modern economy: Rare Earth Elements (REEs/rare earths).

Over the past few years, and especially in recent months, US‑China rivalry has turned critical minerals and REEs into a central front in the broader power competition.

This growing conflict is oriented around a few facts:

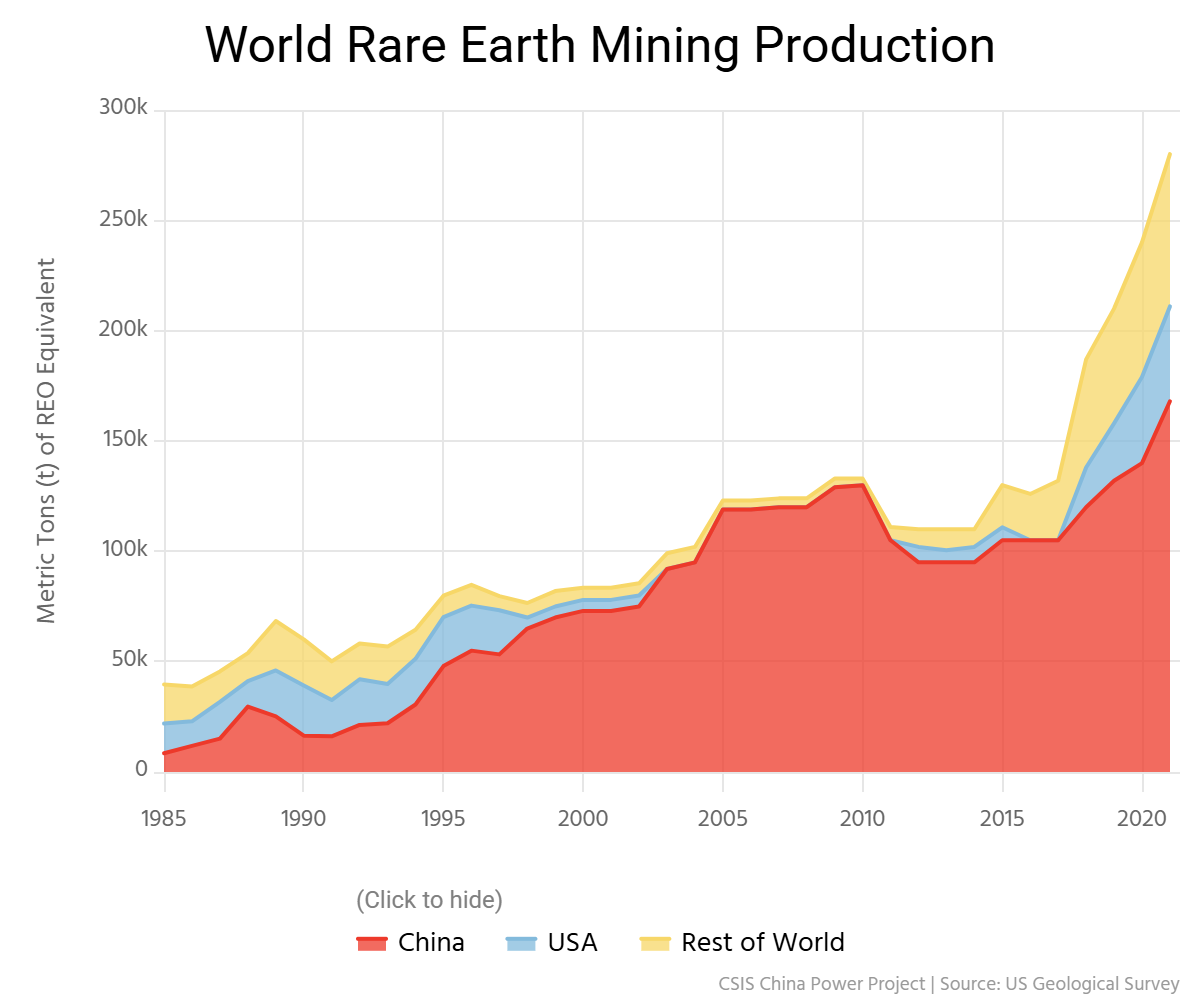

China is the de-facto ruler of the REE industry, controlling roughly 70% of the mining and extraction segment, and over 90% of the refining segment.

Beijing is increasingly willing to weaponize that position to advance its geopolitical agenda.

Rare earths (and critical minerals) are perceived today, more than ever, as a critical component of National Security1

The US and its allies are rushing to break free of China’s chokehold over REEs, in what sometimes seems like a frenzy to make deals and sign agreements

Given a flurry of deals and announcements made by the US and its allies, there’s one big question that’s on everyone’s mind: Will it work?

CFR’s Mike Froman argues that two constraints define the challenge of reducing dependence on China: time and money, accumulated over decades of Chinese investment, IP building, and global mine control.

A Crude Look at the Whole

Over the past few months, the US has rolled out a flurry of investments, agreements, and deals to counter China’s dominance over rare earths. At first glance it can look like a chaotic frenzy, but there is actually a deliberate structure underneath.

Instead of moving one tool at a time, Washington is running a six‑layer, multipronged strategy that plays to its structural advantages:

Defense authorities (DPA, Office of Strategic Capital), export finance (Ex‑Im and DFC), executive orders, alliances, capital markets, and financial instruments like loans, guarantees, and offtake agreements.

Taken separately, these moves buy time and money; together, they offer a real shot at loosening China’s grip and edging toward mineral independence.

6 Degrees of Separation

Let’s review the current US playbook for breaking free of China’s chokehold:

Layer 1: Financial De-Risking

TL;DR: Financial de‑risking unlocks private capital, but it still puts real - if smaller - costs on US taxpayers.

What’s going On: China uses its control over the industry to manipulate prices and create artificial surplus of REEs to bring prices down. This in turn makes it hard for private companies to compete, often sending them into bankruptcy. To develop a US or allied industry, private firms will need guarantees and protections.

The US has engaged in a few interesting tactics to de-risk investments:

Price Floors: Everyone remembers the 15% equity stake in MP Minerals. But what was interesting in this deal was the $110/kg price floor

Letters of Intent: Using the Export-Import Bank to provide letters of intent of $2.2B to Australian companies to catalyze $5B worth of investments

Loans: Using the DPA, the US government can provide loans

These tools provide US companies with the guarantees they need to make long-term plans and investments and protect themselves against Chinese market interference.

What Success Means: Increased number of mines and refineries that can withstand Chinese price shocks and support resilience in face of increased export controls

Layer 2: Bilateral Agreements

TL;DR: Bilateral deals jump‑start private investment while shifting much of the risk and heavy lifting onto partners

What’s Going On: The US can’t do it alone. It needs friends and allies to overcome China’s gargantuan foothold.

The US is leveraging its dealmaking flair to create a series of bilateral agreements to boost production and catalyze investments. These partnerships allow the US to overcome some of its own innate challenges, like permitting and environmental concerns and share the load of buildout required to stand up refining and separation operations.

Examples:

Australia: $8.5B initiative with $1B from each nation

Saudi Arabia: 49% Department of Defense stake in new rare earth refinery with Maaden and MP Materials,

Japan: Critical Minerals Supply Security Rapid Response Group, mutual stockpiling, $2-3B combined investment target

What Success Means: A visible share of global REE mining and separating taking place in US-allied nations, allowing US and allies to withstand Chinese shocks

Layer 3: Defense Procurement to Make Markets

TL;DR: Defense procurement turns the Pentagon into an anchor customer, catalyzing private investment while ramping up domestic production

What’s Going On: To help US and US allied companies compete with the Chinese decades-old head start, the US government deploys its own defense apparatus to kickstart the market. The Pentagon and Dept of Defense/War are centrals players.

Examples:

Long-Term Offtake Agreements: As in the MP Materials example, the DoD/W acts as a contract guarantee, allowing companies to take that to the bank. This is a similar dynamic to what we see in the Renewables market, where Hyperscalers often serve as Offtakers to help First of a Kind factories receive funding

2027 DFARS Regulatory Cliff: January 1, 2027 ban on Chinese rare earths at ANY stage of defense platforms forces defense contractors to qualify alternatives now

Strategic Stockpiling: With $1B+ in new National Defense Stockpile acquisitions, the government is able to, once again, guarantee demand and help de-risk investments

Using the state apparatus to help de-risk the market is similar to layer 1, but also different. In layer 1, the US is investing and acting as a financial actor. In layer 4, it uses its power as a purchaser and a customer.

The DPA is the main tool here, letting the government channel funding and priority support to private projects on national security grounds.

What Success Means: DoD/W becomes anchor customer for several US companies, who are able to ramp up production and serve defense contractors after 2027

Layer 4: Multilateral Coordination

Bottom Line: Multilateral deals are slow and rare, but they deepen coordination with allies and give the US more geopolitical weight to counter China

What’s Going On: Bilateral deals only go so far. Standing up a truly resilient supply chain requires multi‑country frameworks that coordinate investment and standards, even if they are slow and messy.

When it comes to mineral independence, the Administration is the first to join forces with other like-minded countries, often framing the enthusiasm as “America First”.

Examples:

Pax Silica: A multilateral partnership between the US 6 other countries designed to “partner on securing strategic stacks of the global technology supply chain”. This includes critical minerals, and, you guessed it - rare earths.2

G7 Critical Minerals Production Alliance: Coordinates investments among G7 nations while respecting existing bilateral deals, mobilizes private capital

G7 Critical Minerals Action Plan: Standards-based markets countering non-market policies, transparency and traceability roadmap

While not strictly multilateral, the Administration’s usage of international institutions is also striking.

What Success Means: A REE “NATO” type arrangement and a reduction in China’s standing as a single point of failure

Layer 5: Domestic Industrial Policy

TL;DR: Domestic industrial policy is essential for real mineral independence, but it will be slow, messy, and can’t be fixed with a few executive orders.

What’s Going On: Even with friend‑shored refineries, the US needs more domestic production to get close to mineral independence. However, permitting, local opposition, and politics make that hard. The administration is leaning on national security directives, the DPA, and Trump’s favorite: Executive Orders.

Examples:

US National Security Strategy: “The United States must protect… This means ending (among other things): Threats against our supply chains that risk U.S. access to critical resources, including minerals and rare earth elements”

EO 14154 (January 20): “Unleashing American Energy” mandating robust National Defense Stockpile

EO 14241 (March 20): Streamlined permitting plus DPA authority delegated to DFC, federal lands prioritized for mining

EO 14272 (April 15): Section 232 investigation on critical mineral imports launching tariff and import restriction assessments

Using EOs helps solve problems, but it’s no panacea. It will take a long time until the US can accelerate buildout to stay on par with China.

Again, the DPA plays an important part of promoting domestic production capacity, allowing the government to override standard market signals, which are often impacted by China’s actions.

Some projections have the US sourcing around 90% of domestic demand locally by 2040, a monumental lift.

What Success Means: Increased US production of several heavy REEs and faster mining permitting process

Layer 6: Innovation & Circularity

TL;DR: Innovation, recycling, and using fewer rare earths are the only real levers the US has to chip away at China’s technology and IP lead.

What’s Going On: At the end of the day, China is a few decades ahead, and much of the competitive advantage is not in the buildings and facilities they have, but rather the IP: It’s the ability to separate, process and refine REEs.

To get ahead, the US can choose three strategies (or all of them):

Pathway 1: Urban Mining: Turning scrap into a strategic asset. By scaling recycling for magnets and motors, the US creates an “above-ground mine” that offers faster access to materials than opening new pits

Pathway 2: Next-Gen Processing: The US can invest in next-gen technologies that will leapfrog ahead of existing Chinese impact

Pathway 3: Use Less REEs: One way of innovating its way out of this mess is to develop industrial products that are not as reliant on REEs as they are today

All three paths are viable, but they will need sustained R&D funding and a mini industrial policy focused on advanced materials and recycling.

What Success Means: A growing share of demand is met with recycled magnets, while overall reduction in reliance on REEs is somewhat achieved

Playing to Your Advantage

What I find particularly interesting is that Washington is not trying to, and probably cannot “out‑China” China on centralized command and environmental tolerance; Instead, it is leaning to what it already has:

Advanced R&D: World‑class labs and companies to push new processing technologies, recycling, and material substitution.

Market Making & Regulatory Powers: Using DoD/W, Ex‑Im, DFC and the DPA to act as anchor customer and financial backstop

Leveraging Global Architecture and Alliances: Leveraging NATO, the G7 and wider treaty networks to share the build‑out burden and require major defense contractors to get off Chinese inputs.

What Could Possibly Go Wrong…

Plenty. This is a complex strategy that requires many moving parts to work together in harmony, or at least not to get in each other’s way. It must also reduce the US’s dependency on China, whatever that means.

Still, it would be helpful to breakdown what could go wrong:

Investors Can Walk Away: US permitting and regulation takes a long time. Even with US guarantees, this can be too much for investors who expect returns.

Chinese Countermeasures: Beijing can build counter‑coalitions and still flood the world with cheap finished magnets and components.

NIMBY: Local opposition can quietly kill projects, as seen in other energy and infrastructure fights. Don’t believe me? Ask Microsoft.

Traditional Failures: Projects can slip, overrun budgets, or fall short of the hype, and alliances can fray.

The Road Ahead

The real test of Washington’s rare earths playbook is brutally simple: does it actually bend the fundamentals of the market away from Beijing, or just generate headlines. Over the next decade, there are three scorecards to watch.

Does domestic and friend‑shored production of oxides, metals and magnets actually come online at scale, or stall in permitting and price wars

Does China’s leverage in trade and security talks shrink as buyers gain credible non‑Chinese options.

Do US‑aligned firms keep investing downstream into magnets and components once the first wave of subsidies and guarantees fades.

If the US really plans to meet most demand locally by 2040, the next decade will show whether this playbook works. Western independence may hinge on it.

Thanks for reading! Don’t forget to subscribe or share your thoughts. 🔽

See you next week!

I recommend reading Amanda van Dyke’s mineral-focused analysis of the US NSS.

I will concede this is an implicit inclusion, but critical minerals are mentioned directly, which often includes rare earths.