Everyone Talks About the AI Bubble. You Should Focus on Rare Earths Instead

There's a storm brewing and you're not paying enough attention

Climate change is reshaping power, money and markets. I help you stay on top of it!

Hey there👋

In this edition:

Why You Should Pay Attention to Rare Earth Elements (REEs)

How China created a new geopolitical moment with REEs

Are REEs the new DefenseTech?

You should read this if you’re…

Bored of the AI bubble talk and looking for new fun

Looking to learn more about the new center of the global economy

Before we continue - if you like my writing and memes, please subscribe to show me the love and force me to write more:

The emerging (yet uncertain) AI bubble keeps everyone busy. Yet, there’s a storm brewing on the horizon that you’re not paying attention to:

Rare Earth Elements (REEs).

If you use an iPhone, travel on airplanes or drive an EV, this is one drama you do not want to miss out on.

What’cha Talkin’ About, Willis?

It feels like AI is all everyone wants to talk about these days:

Is AGI coming (better be yesterday!)

Is there a bubble forming? (god I hope not!)

If yes, when will it explode (and geez I hope I don’t lose all of my money)

And yet, in plain sight, a new storm is brewing, and it revolves around very important, yet little-known, components of our global economy.

I’m talking about REEs, of course.

What are REEs anyway?

REEs refer to a group of 17 metallic elements in the periodic table that have very odd names.

What is unique about this group of elements is that they are often used to provide super powers to other materials. They are used in anything from iPhones to EV batteries to jet engines and are central to the modern economy.

For example:

Neodymium, when added to iron and boron, produces extremely effective permanent magnets found in electric vehicle motors, wind turbines, and headphones.

Europium, when added to phosphors, creates the bright red color seen in LED screens and display monitors.

Gadolinium, when included in medical imaging agents, greatly enhances the contrast and clarity of MRI scans.

REEs, despite their name, are not actually rare. They are just found in trace amounts and are hard to extract, process and refine.

Despite being incredibly important for the global economy, they gain very little public attention, with the last few weeks being a notable exception (thanks China!).

And now there is a brewing storm that makes paying attention to them more important than ever.

The Geopolitical Awakening of REEs

I admit, I took my time with this post. I wanted to see if the latest slew of articles represent a fad and a fleeting concern. But I became convinced over the past few weeks (months?) that REEs are the linchpin of a new geopolitical moment and the breeding ground for new geopolitical conflicts and competition.

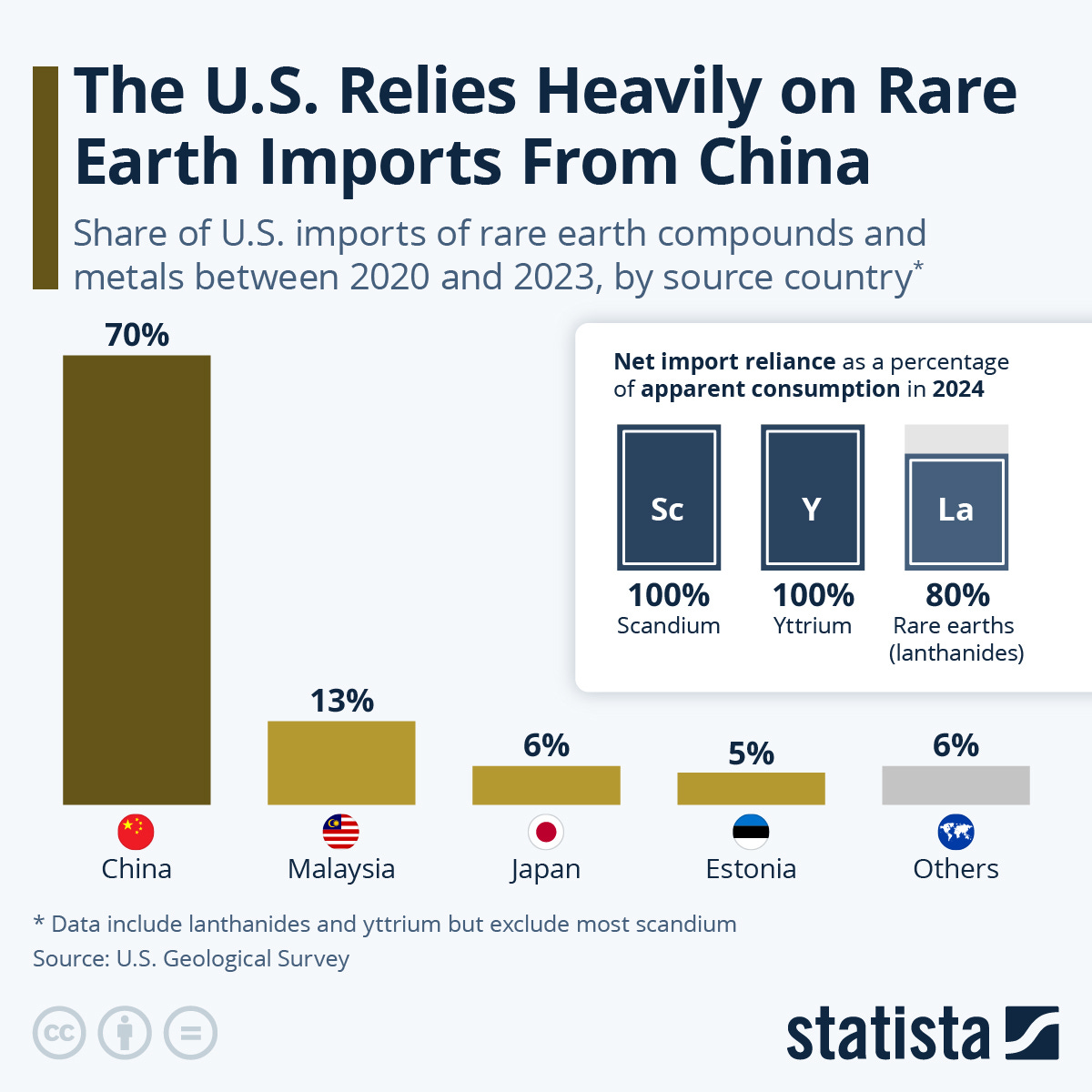

If you are wondering, like I did, how we got here, the answer is quite simple:

REEs are becoming increasingly central to the modern economy with each passing technological innovation

China spent the last few decades building capacity, expertise and specialized know-how to secure overwhelming control over the supply chain. It also helps that they have large REE deposits

China’s dominance over REEs isn’t only due to their deposits or their refining and processing acumen. China built a gargantuan ecosystem that spans across extraction to export of REEs

As long as China was playing nice, the world was pretty much okay with it, allowing countries become too reliant on them

Breaking free of China’s stronghold over REEs will require years of playing catch-up, a lot of money and technology innovation. Not to mention the environmental toll.

China is willing today more than ever to place restrictions on REE exports and leverage REEs in geopolitical flex and trade negotiations

Now, world nations are like “wait, what”

What was once a boring business issue is now at the center of global politics and trade wars.

China’s moves and its increasing willingness to restrict REE exports creates a new reality that the US, its allies and China’s neighbors are slowly awakening to. And they are not willing to just roll over.

They are reacting and retaliating.

OK Yeah But What Happened?

To tell the truth, if you’ve been following the nerdy side of the news, you have seen a few interesting movements in recent years:

The US Govt. invested $400M in MP Materials, the only US based operator of a REE mine (Reuters)

The Pentagon has launched a comprehensive plan for rare earth elements

US-based Critical Metals bought Greenland’s Tanbreez REE deposit in 2024 (Tanbreez)

These moves are clear attempts to break free from China’s stranglehold over REEs, a concern shared by both Biden and Trump administrations.

And yet, the real drama kicked into high gear just recently:

📰China moves to tighten REE exports, mostly for defense and chip users (Reuters)

📰In retaliation, President Trump announces 100% tariffs on China (BBC)

📰The Pentagon scrambles to stockpile REEs and other critical minerals to the tune of $1B (Mining.com)

If you thought that was the end of it, you couldn’t be more wrong.

A Storm Brewing on the Horizon

We are in a new geopolitical moment.

REEs are both pieces on the chessboard and a new kind of currency, used to trade blows in a bigger game for power and influence between world powers (or, China vs. everyone else).

China’s restrictions and the US’s reaction have sent everyone scrambling.

Don’t believe me? Check out these moves:

Japan is looking to coordinate with G7 countries against China (Nippon)

Europe did what it knows best: Held meetings with China (IndiaTimes)

JPMorgan has announced a new Security and Resilience initiative that targets $1.5T over 10 years to strengthen US supply chain, targeting critical minerals and REEs

There are no signs that China is backing down, despite growing criticism (as was argued recently by the Council of Foreign Relations). But even if it did, China’s willingness to weaponize REEs signals, to me, a path of no return.

Other countries woke up, and they did not like what they saw.

The implications (both positive and negative) to the global economy are far reaching and consequential:

Western countries and China’s neighbors are finally realizing they need to invest heavily in the REE supply chain, trying to develop capabilities and knowledge they did not have before

If successful, Western countries might break free from China’s stranglehold, with the Dragon losing a powerful card, tilting the balance of powers away from China

New capacity, new supply chains, and new infrastructure will likely be built

New build and new budgets by national governments and large institutions (hey JPMorgan) will spur new investments, attracting many newcomers who are looking for a

quick bucksolid investment opportunitiesAt the same time, REEs harbor dramatic risks for the planet, since their extraction, processing, and refining are carbon intensive and polluting

REEs are the new DefenseTech?

Growing defense threats and geopolitical rifts led to the rise in defense budgets and a pressing need to rearm, causing a surge in a new field of technology named DefenseTech.

With the new geopolitical moment we are in, are REEs the new DefenseTech? Has China, with its latest sparring exercise, created an environment where REEs will be a sustained source for innovation and investment?

My bet? Yes.

Like with every traditional industry, there are plenty of opportunities to innovate. Some potential ideas:

AI can help track rare earth deposits

Advanced materials innovation can help create cleaner extraction and refining processes

Enterprise software can create efficiencies in complex supply chains

The list can go on, but the point is that this geopolitical moment that we’re in can also be a force for good, in the sense that it creates urgency to modernize the industry and inject new, emerging technologies.

More REEs Incoming

I get obsessed with some topics, I admit. REEs are my latest obsession.

Which is why I will be breaking down the topic more in depth in the coming weeks. Stay tuned for more content, fun and surprises!

Shoutouts before you go

I’ve seen some more writing about REEs recently and wanted to recommend some of my favorite takes:

Dean W. Ball’s Hyperdimensional provides excellent analysis on the need to break down China’s chokepoints

Noahpinion weighed on the topic and argued the US can beat China if it wanted to

The ultimate expert on minerals here, Critical Minerals Journal gave a crisp explanation and analysis of the tensions between US and China

If you’re into REEs, check them out!

That’s it for this week.

See you on Saturday for another edition of the Time Machine

Don’t forget to subscribe 🔽

And if you have any comments, thoughts or suggestions, I’d love to hear from you in the comments (I also need the traffic 🤷♂️)

Excellent breakdown. The rare earth supply chain story gets nowhere near enough coverage compared to AI hype definitely agree this is the next big economic lever. Curious if you have a list of awesome tech/research newsletters that track DefenseTech or global minerals innovation? Would love to add more to my daily read.