Vegas, Baby!

The state of Nevada has more to offer to the future of the US than just casinos

👋 Welcome to A World Reconfigured - your guide to a world changed by climate, geopolitics and technology. I write about how climate change is creating a new world with new rules, and often cover topics like the ❄️Arctic, 🤷♂️Rare Earths and 💻Data Centers.

If you happened to receive this email from a friend, please consider subscribing. If you’re already a part of this community, I’d love it if you could recommend to a friend.

Last week, I spent some time in Las Vegas, Nevada.

No, I not there for the casinos.

I attended a conference for work and came back with a terrible cold a realization about Nevada’s role in the new cold war of critical (and rare) minerals.1

Airplane Mode

The plane took off.

As Las Vegas faded into the horizon, canyons, creeks and valleys started taking over from the colossal replicas of real-world monuments that were lumped together into a megapolis.

It only took 10-15 minutes for us to start flying over deep time and the state’s geological endowments. Suddenly, I was no longer looking at an urban jungle, but at a real desert.

Since I spend an increasing amount of time thinking about rare earths and critical minerals, I couldn’t help but wonder if Nevada has more to offer to the future of the US than just Casinos.

States, like countries, compete for power, funding and talent. They compete for brand and allure. Different states have different assets to offer, some tangible and some more ephemeral.

When it comes to America’s ability to secure its future, California brings Silicon Valley; Virginia brings Data Centers; New York brings the Knicks NYC; and the list goes on.

And Nevada? Critical minerals.

In Vogue

Critical Minerals are in vogue these days.

Thanks to China (and the gross negligence of much of the Western world), they were all over the news these past few months.

The term “Critical Minerals” is often thrown around in a cavalier fashion, but there’s a method to the madness: Clear definition + defined list.2

Critical minerals are defined by Executive Order 13817 as:

…a mineral identified by the Secretary of the Interior pursuant to subsection (b) of this section to be (i) a non-fuel mineral or mineral material essential to the economic and national security of the United States, (ii) the supply chain of which is vulnerable to disruption, and (iii) that serves an essential function in the manufacturing of a product, the absence of which would have significant consequences for our economy or our national security.

Put simply, critical minerals are a bunch of minerals that are very important to national security or the economy.

If we think about it, it’s not that weird. Some minerals are critical in making the cars we drive, the planes we fly in, the laptops and phones we use. They are also critical in the things that allow our countries to operate and defend themselves.

Therefore it’s not a good idea to let foreign countries control our ability to procure them.

Critical minerals are listed by the US Geological Survey (USGS) every few years. As of 2025, the US has designated 60 minerals as critical, adding Copper just recently.

The list includes some well-known minerals like Zinc and Tin, but also some obscure ones like Iridium and Tantalum (I honestly have no idea what this last one is 🤷♂️).

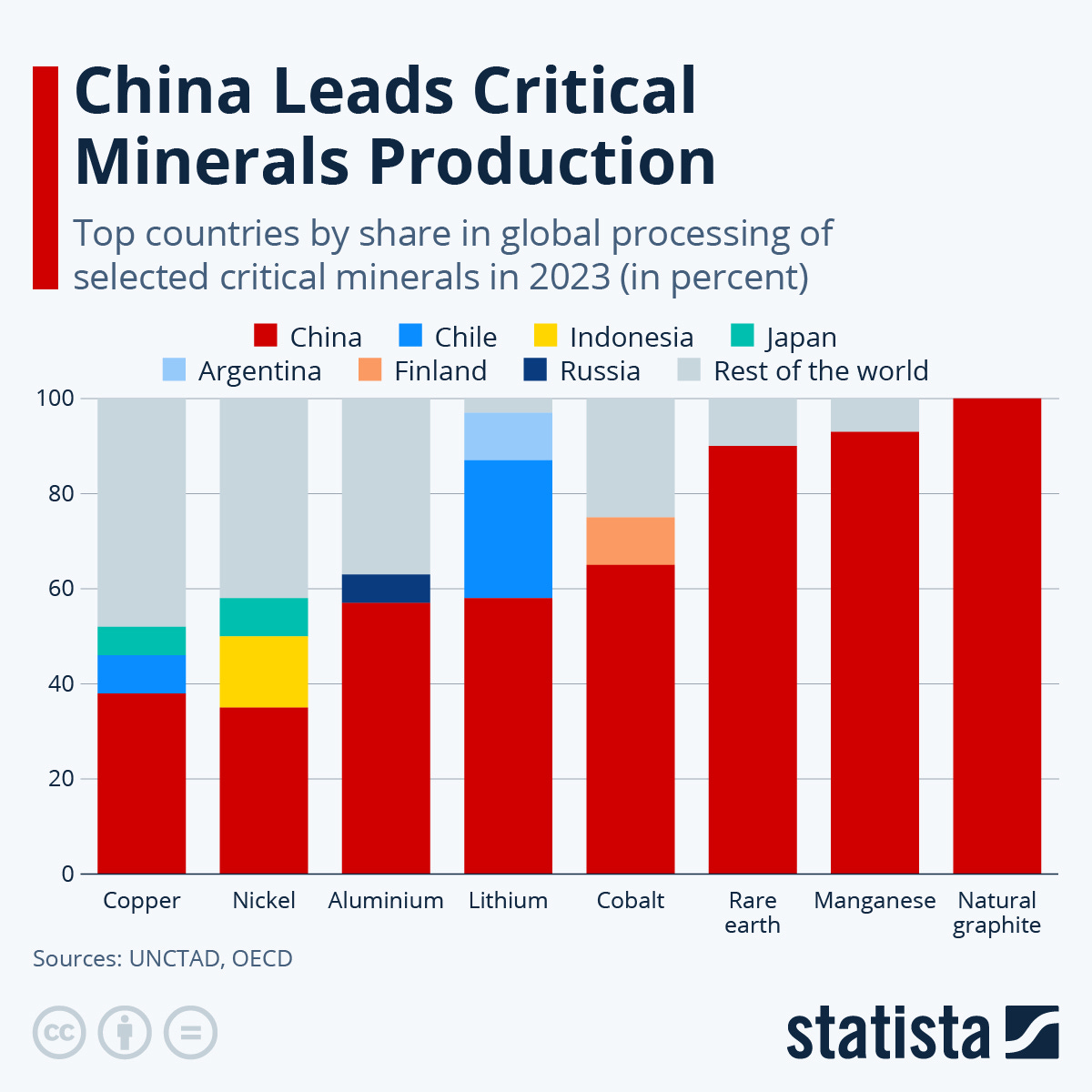

Over the past few decades, as we are now acutely aware, China developed mastery over mining, refining and processing of critical minerals.

To get a sense of the US’s reliance on critical minerals, here’s a fun chart:

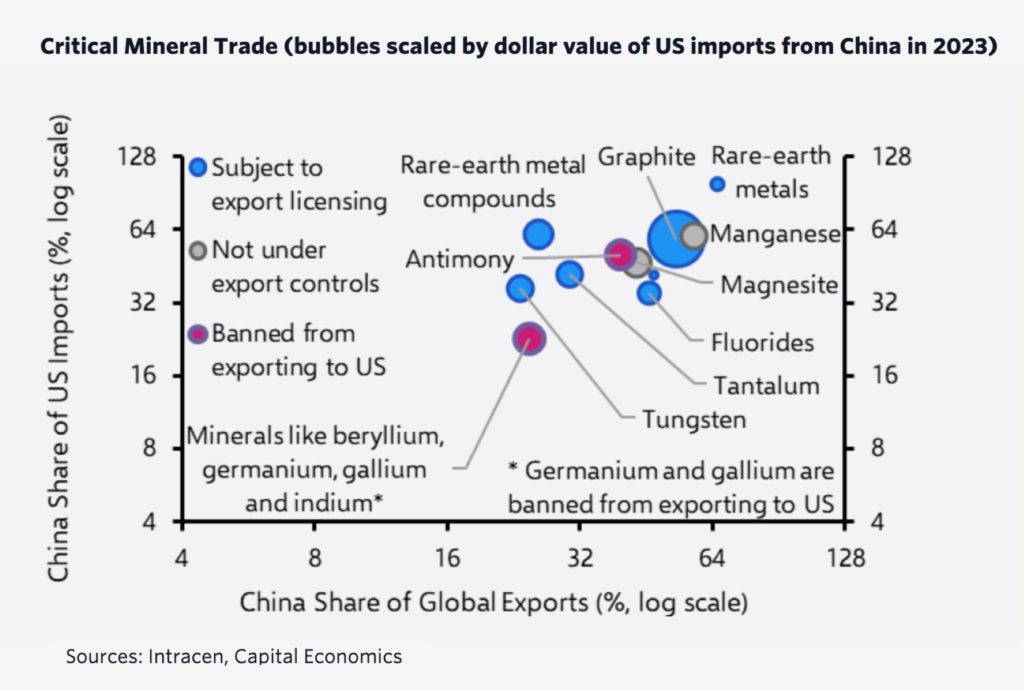

Given China’s recent moves regarding export controls, this reality is making a lot of people nervous.3 It has led the US to rethink its strategy, which for the past 20+ years has meant mostly offshoring capabilities and closing down facilities.

Born in the USA

The crazy thing about the past 20+ years of US shutting down mines and facilities is that the US has way too many critical minerals.

Ok, fine, there are plenty of good reasons for why this happened, other than costs (environmental reasons is one example), but in hindsight, it was probably not a very smart move.

Ok, I’m done judging.

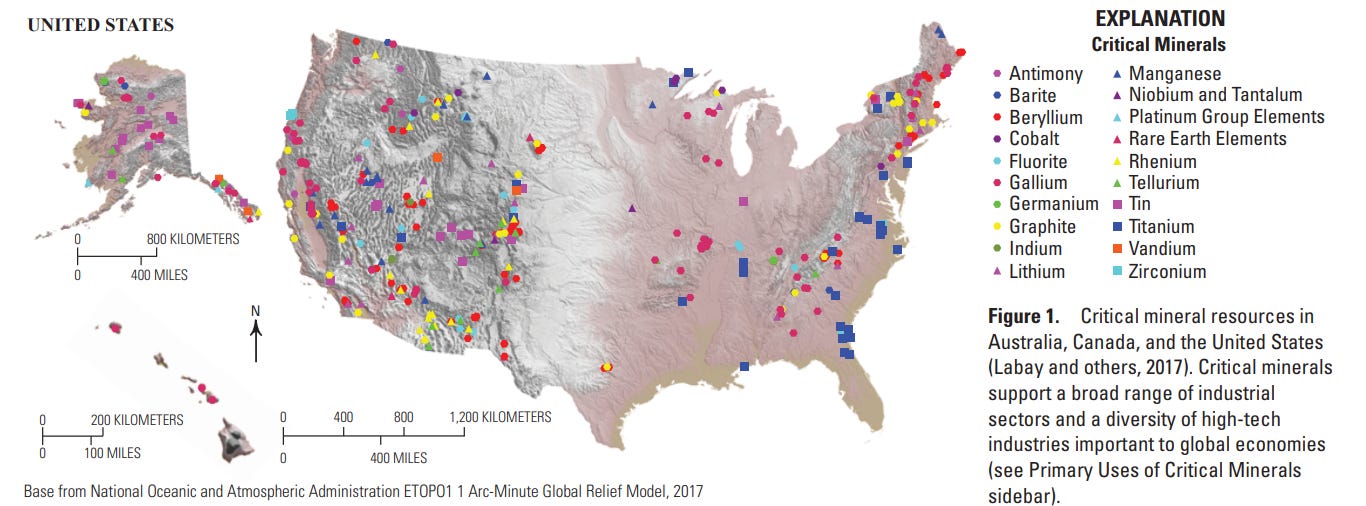

The US has plenty of critical minerals, but they are not evenly distributed:

Looking at this map, three things come up:

I was flying over a lot of very expensive rocks!

Deposits are not evenly distributed. Majority of deposits are centered around the American West, both in quantity and diversity

Distributed deposits mean that as the US is attempting to gain mineral independence, different states will have a different role in securing that future

Nevada plays a unique and interesting role in that future.

What Happens in Nevada…

When it comes to securing the US’s future as minerally independent,4 the state of Nevada has more to offer than just casinos and the occasional (although mesmerizing) show at the Sphere.

In fact, Nevada might have more influence over our lives than we realize.

Let’s take a closer look:

Mineralapalooza!

Nevada is home to at least 33 out of the 60 listed critical minerals.

While not all are of sufficient quantity and quality to mine, Nevada is proud to have so many critical minerals found within its borders. Still, it is home to three primary minerals: Lithium, Antimony and Copper.

Lithium

Nevada is the US’ leading lithium producer, responsible for over 80% of the US’s production, with its mineral-rich deserts serving as the heart of the nation’s primary supplier of a mineral critical for EVs and batteries. Nevada is the only US state with a “Lithium Loop”, with capabilities across extraction, processing, battery manufacturing, and recycling.

There are significant projects underway to expand the current capacity of 7,500 tonnes to roughly 160,000 tonnes annually (for example, Thacker Pass and Rhyolite Ridge)

Antimony

Nevada is the US’s leading source of new antimony production potential, used in batteries, semiconductors, and defense applications. Nevada hosts some of the highest-grade antimony projects in North America, centered on sites like Limousine Butte and Last Chance. These projects are advancing to commercial scale, aiming to restore domestic supply chains and reduce US reliance on China.

Copper

Nevada is a top US copper producer, supplying over 160 million pounds of copper annually from its mineral-rich mines (roughly 6% of total US output). Copper is a vital building block for electrical infrastructure, renewable energy projects, and manufacturing across the country.

Aside from these three, Nevada is home to an assortment of other minerals, like Tungsten, Nickel and perhaps even some Cobalt.

Aaaand… Action!

Ok great. Nevada has plenty of important minerals and lots of mining companies. But what is happening in practice?

Turns out - quite a lot.

Nevada created the “Lithium Loop” initiative, linking state government, mining companies, gigafactories, and recycling startups to anchor a full lithium-to-battery supply chain in one jurisdiction.

Hawthorne Army Depot established as the US Strategic Minerals Reserve facility for storage and management (August 2025)

DOE approved $2.26B loan for Thacker Pass lithium project construction and expansion (September 2025)

Rhyolite Ridge lithium-boron project received federal permit and nearly $1B financing (October 2025)

The Pentagon awarded $6.2M to Pilot Mountain tungsten project for defense-grade production (July 2025)

That’s quite a laundry list of things that took place just this year. To me, this means that Nevada is well aware of the role it can play in the American mineral war for independence and is making moves that will bring capacity and capability.

It will be interesting to see if Nevada keeps up this pace and will continue to invest in its mining sector, which can well be a way to secure more internal power in the US and attract more federal funding at a time where every mine counts.

I guess I will have to explore that next time I’m in town (as you can probably understand by now, I’m not a big fan of casinos🤷♂️).

Thanks for reading! If you enjoyed this edition, don’t forget to subscribe or share your thoughts. 🔽

See you this weekend!

If you are wondering why there was no edition of the roundup - blame air travel and a flu.

Well, it’s a bit more complicated than that. Apparently there are multiple and duplicative lists, argue Dr. Gracelin Baskaran and Meredith Schwartz (https://www.csis.org/analysis/three-us-government-lists-which-minerals-are-most-critical)

There has been an endless stream of articles and newsletters discussing the issue, showing just how rattled the West is in light of China’s export controls. My favorites include Dean W. Ball’s article and Michael Froman’s (https://www.cfr.org/article/china-united-states-and-critical-chokepoint-minerals)

yes I made that term up

Your not alone.. I spend a lot of time thinking about the same