MOFCOM Cries Foul on CBAM (the Roundup)

Rare Earths are Big in Japan, India added record renewable capacity, Dan Wang's annual letter + all the important stories you've missed (Jan 4, 2025)

👋 Welcome to A World Reconfigured - your guide to a world changed by climate, geopolitics and technology. I write about how climate change is creating a new world with new rules, and often cover topics like the ❄️Arctic, 🤷♂️Rare Earths and 💻Data Centers.

If you happened to receive this email from a friend, please consider subscribing. If you’re already a part of this community, I’d love it if you could recommend it to a friend.

Happy New Year!

This is the first roundup of 2026, and I’m full of excitement about what’s ahead. This year, hopefully, I’ll expand my coverage and bring you a broader spectrum of hidden signals, changes and developments, and more deeper‑dive, analysis‑driven essays.

Yes, the tacky humor will likely remain. No, you cannot file a complaint.

And while we’re at it, if you haven’t had a chance to catch my 2025 end-of-year recap, here’s me reminding you that you can read it here:

Some notes:

I admit this roundup is lighter than usual due to the holidays, but I can’t wait for all the happenings of the coming year.

The roundup will appear next week like usual, but after then I will be off for two weeks. But fear not, I will be working on a collection of essays on a few topics that are on my mind of late: India, Data Centers, US-CN relations, Rare Earths and Insurance.

Hope you enjoy this edition of the roundup, and here’s to a great 2026!

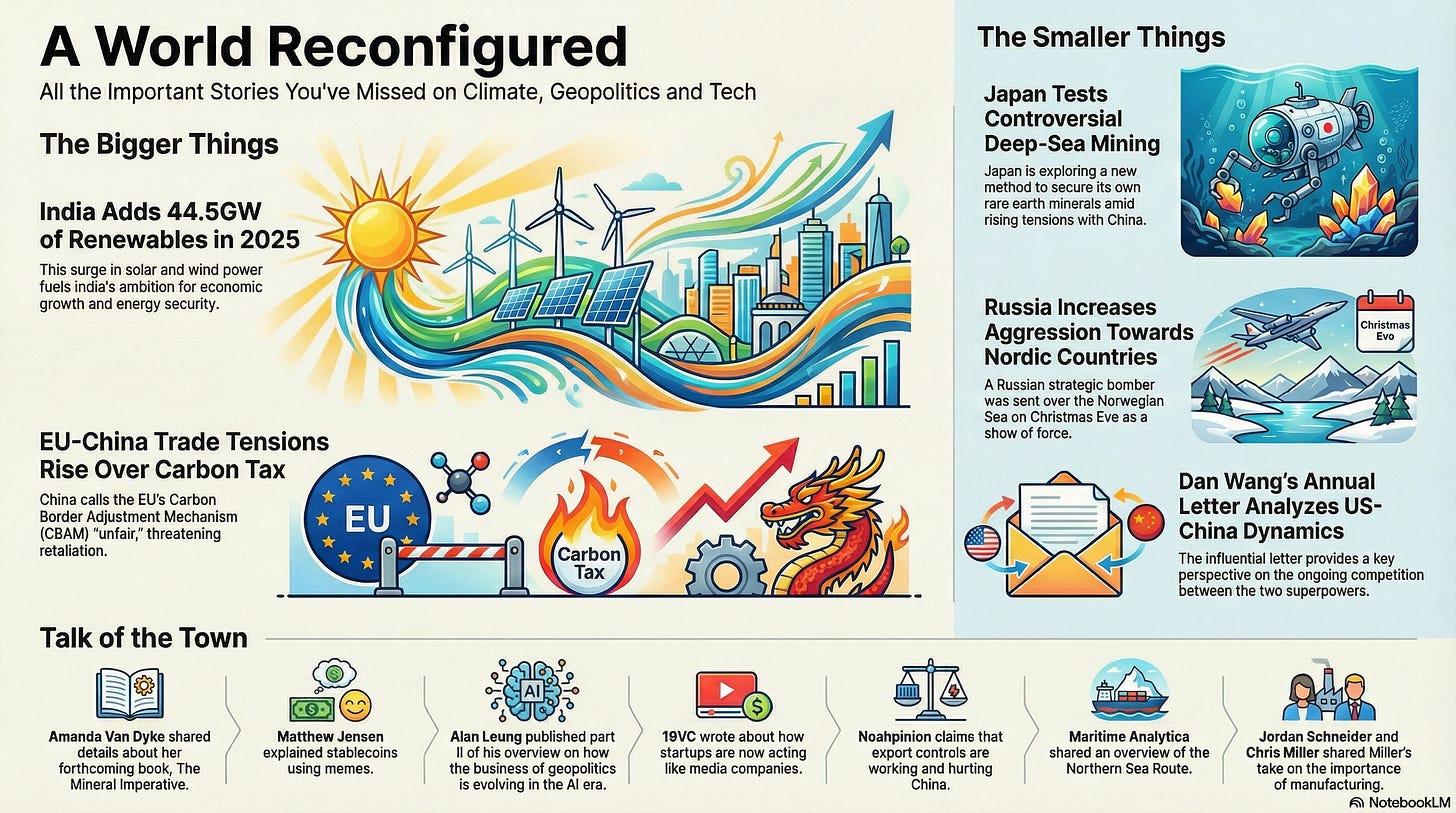

TL;DR

The Bigger Things

India added 44.5 GW in renewable capacity in 2025 (pack your bags we’re going to Delhi)

China’s MOFCOM calls EU’s CBAM tightening unfair (trade meets kindergarten)

The Smaller Things

Japan wants rare earths and is willing to mine the seabed (DSM is now big in Japan)

Dan Wang’s Annual Letter (I think I have a new hero)

The Talk of the Town

The Mineral Imperative, Startups are Media Companies, Export Controls and Stablecoins (and much more)

The Bigger Things

The biggest stories you probably missed:

India Reported Adding 44.5GW of Renewables in 2025

What Happened? India has just announced that it has added 44.5GW of renewable energy, with the majority of capacity coming from Solar, and some from Wind. This announcement comes a few months after India’s announcement that it has managed to power 50% of its total electricity from renewable sources and is linked to India’s goal of achieving 500GW in renewable capacity by 2030.

Why Care? 🤷♂️ Because this is a part of India’s wider ambitions for growth and hegemony. While India has not reached China’s scale, it is quickly following suit and using renewables to power its growing economy at lower costs, gain energy security and build a domestic solar industry.

My Take: ✍️ India is the next big thing in renewable energy, and will likely help keeping the energy transition going as China reports slowdown for the first time in lord knows how long.

China’s MOFCOM Complains about EU’s CBAM

What Happened? Two weeks ago I reported on the EU’s intention to strengthen its Carbon Border Adjustment Mechanism (CBAM) and close some loopholes:

Well, China is not too happy about it. China’s Ministry of Commerce (MOFCOM) has called this step “unfair” and and has threatened to take ‘appropriate measures’ in response. Yeah, they are not too happy about this, I guess.

Why Care? 🤷♂️ Because this is the last thing Europe needs, a tariff war with China. China is a major EU trading partner and a superpower in the making. It’s unclear whether the EU can withstand a trade war with China. China does not shy away from weaponizing chokepoints. Again, lord knows there is no shortage of those.

My Take: ✍️ Europe’s dilemma on China has just become very real: Strengthen climate or risk angering China. We’ll have to see what is Europe’s next step, and whether Beijing will retaliate or it’s just blowing off steam.

The Smaller Things

The stories you should have on your radar:

Japan is Testing Out New Deep-Sea Mining Method

What Happened: Japan decided to test a new method for mining rare earths from the bottom of the sea. In this new pilot, a vessel will continuously lift mud rich in rare earths from 6,000 meters depth and ship it for assessment. If the pilot is successful, this will become a permanent thing.

Why Care? 🤷♂️ Because this is a part of the Mineral Cold War, and Japan is trying something entirely different than most of its Western allies. Deep Sea Mining is a controversial method of extracting minerals and other resources, with significant environmental concerns. Japan does not seem deterred, effectively being one of the only countries in the world actively pursuing rare earth mud mining.

My Take: ✍️ The race is on, and Japan seems to be in a pinch to supply its own rare earths. With tensions rising high between Tokyo and Beijing, Japan understands that it must decouple from China as much as it can.

Easy Christmas? No Way

What Happened: On Christmas Eve, Russia decided it was cool to send a TU-95 strategic bomber to the Norwegian sea. The bomber had no missiles on board, but its location begs the question - why? Obviously, because Russia can.

Why Care? 🤷♂️ Because this is example #50004048 of increased Russian aggression towards the Nordic countries.

My Take: ✍️ Sure, why not. It was a slow news week anyway, so why not provoke someone.

Dan Wang’s Annual Letter

What Happened: Ok, not exactly a happening per se, but Dan Wang published his annual letter, and it is a masterpiece of writing and analysis. In it, Wang provides an updated take on the US-China competition and provides his take on what both sides get right and get wrong (at least, that’s how I read it). Wang covers a wide range of topics: from magical thinking and the wonders of Silicon Valley to Chinese competition.

Why Care? 🤷♂️ Because Wang’s voice represents a growing thread of thinking on US-China relations and his thoughts represent both a growing consensus of how the US should compete, but also an accurate view on the differences between the two countries.

My Take: ✍️ I admit I have not read Breakneck just yet, but it’s definitely on my to do!

Talk of the Town:

I read way too much Linkedin, Twitter and Substack for my own good. Here are a few of my favorites this week:

✍️ Amanda van Dyke shared details about her forthcoming book, the Mineral Imperative. Can’t wait to read it!

✍️ Matthew Jensen taught us all about stablecoins in the best possible way: with memes!

✍️ Alan Leung published part II of his overview of the business of Geopolitics, helping us see how geopolitics as a trade is evolving in the AI era.

✍️ 16VC wrote a great piece about how startups act today as media companies - which got me thinking - can climate startups do the same?

✍️ Noah Smith claims that export controls are working and hurting China. We’ve seen them hurt the US on rare earths, so overall agree.

✍️ Maritime Analytica shared an overview of the Northern Sea Route, a topic I care deeply about

✍️ Jordan Schneider and Chris Miller shared Miller’s take on the importance of manufacturing. Personally, I thought it was a great take that helps spell much clarity on the topic

Thanks for reading! If you enjoyed this edition, don’t forget to subscribe or share your thoughts. 🔽

See you next week!

Great writing as per usual, Arod!

I got a little bogged down in books I’d already started but am happy to share I’ve now finished Breakneck and will share my thoughts soon (but suffice to say, I like Dan Wang too!)

Appreciative for the shoutout :)