Gene Editing for chocolate, Norway wants your CO2 and other things you should care about this week

This week: Australia brings a giant battery live, MARS wants you to have genetically modified M&Ms and startups are selling climate data to NOAA + shoutout to Binding Solutions

Happy Saturday! Welcome to the time machine, where we look at the past week and try to pretend things are normal.

I’m still trying new things and new formats, so I have added a table of content to make sure you don’t run away after 5 seconds.

Hope you enjoy this edition!

In this edition:

Bigger Things:

Australia’s giant battery goes live

Norway thinks it’s a good idea to sink CO2 in the Northern Sea as a service

Food Banks are now Carbon traders

Smaller Things:

Startups sell data to NOAA

Want money? Say AI

Gene Editing comes for your M&Ms

The EU wants to make sure the Spanish blackout doesn’t return

Cooler Things:

France & UK’s satellite love child hunts for carbon

Startup Shoutout: Binding Solutions

The Bigger Things

Australia’s Giant Battery Goes Live🔋:

What Happened? Australia’s A$1B Waratah Super Battery came online, with plans to expand scale later this year, acting as a fast grid shock absorber under the state’s protection scheme and aiming for the world’s largest grid battery power output. When fully commissioned, it will be able to power 1 million homes for an entire hour.

Why Care?🤷♂️ On the recipient end of many climate sucker punches, Australia realized it has to do something about its grid and to make sure it doesn’t succumb to shocks. Batteries seem to be the country’s chosen method. Good luck to them!

Norway Opens Northern Lights Project 🫙:

What Happened? Northern Lights, the carbon storage project off Norway’s coast, started accepting shiploads of CO2 from European industries for underground injection. Backed by Equinor, Shell, and TotalEnergies, the facility launched its first phase with capacity for 1.5 million tons of CO2 per year and plans to expand further.

Why Care? 🤷♂️ Aside from being very big, this project represents an interesting national strategy by Norway to leverage its unique geology and geography to become a decarbonization hub. In essence, Norway, through its LongShip program, is betting on a leadership role through open access and CO2 shipping across jurisdictions, offering services to emitters without the capture and storage capabilities. So cool.

Food Banks are now in the Carbon Credit Business 💳:

What Happened? Food banks in Mexico and Equador are piloting a new system to create carbon credits by measuring methane avoided when they divert surplus food from landfills. The Global FoodBanking Network is seeking certification for this climate impact method, but critics worry about carbon market lawlessness.

Why Care?🤷♂️ Because carbon markets are permeating, and become an attractive opportunity for, a growing list of institutions that either find it an effective method to reduce emissions or just think of it as a lucrative revenue stream. Both options show the growing financialization of carbon and emissions. In a way, climate change has created a new financial market that makes investors and now even food banks very excited. Will it help the climate? Opinions are split.

The Smaller Things

Startups Sell Data to NOAA 📅:

What Happened? Amidst deep NOAA cuts, startups like WindBorne and others are selling balloon, buoy, drone, and satellite observations that the agency can ingest. Still, former officials warn missed contracts, shrinking headcount, and proprietary feeds could erode data continuity and forecast quality

Why Care?🤷♂️ Because it’s a part of a broader trend to privatize climate services worldwide, and is part of the reconfiguration of climate data in the US. Traditionally subsidized, climate data now is becoming privately collected and sold to governments and businesses. This move will be very lucrative to data startups, but may not in the best interest of the public long-term.

Want Funding? Say AI🪙:

What Happened? Investors are funneling more money than ever into clean power, storage, and grid solutions that can serve AI’s exploding electricity demand, with startups that work in the Data Center and firm power space seeing a funding bump despite a tougher market for other green startups

Why Care? 🤷♂️ Because ClimateTech isn’t dead. It just needs a better story, and that story is AI. Honestly, that’s good news, as many fear that the climate startup scene is on its way to an early demise. It turns out the industry is adapting and keeping up with the times, focusing on AI to get a piece of the growing investment pie. Looks like ClimateTech is more resilient than the climate itself.

Genetic Engineering comes For Your Chocolate🍫:

What Happened? Mars is using gene editing tools, CRISPR and Trait Libraries, on cacao, aiming to speed breeding for traits that increase disease and heat resilience after supply shocks and soaring prices exposed how climate and pathogens are squeezing West African production.

Why Care? 🤷♂️ Because if they are not successful, a packet of M&M might cost as much as Caviar. Climate change is sending commodity prices through the roof📈, and companies are scrambling to find ways to make crops more resilient to contain costs. Climate-related shocks are already starting to reconfigure this multi-billion dollar industry towards more resilient infrastructure, and this is another sign of this transition.

EIB Funds Valencia Grid Climate-Proofing ⚡

What Happened? The European Investment Bank agreed to provide €50 million in loans to Iberdrola to rebuild and climate‑proof flood‑damaged distribution assets in Valencia, funding undergrounding, raised substations, smart transformers, and digital controls to harden supply for hundreds of thousands of customers.

Why Care? 🤷♂️ Because otherwise, we might get more summer blackouts, as seen during the 2025 Iberian Peninsula Blackout. The EU recognizes the need to modernize its aging infrastructure to avoid grid shutdowns, especially as the climate becomes more erratic and extreme. We should expect more projects like this to take place, as Europe is trying to modernize its energy sector.

The Cooler Things / Something Odd

UK + France = Love in Space 📡🛰️

The UK and France launched MicroCarb, their space climate love child.

MicroCarb is Europe’s first dedicated CO2-monitoring satellite, designed to map urban emissions at roughly 2km×2km resolution, aiming to verify national targets and strengthen carbon accounting through a joint UK–CNES mission backed by £15m from the UK Space Agency, with first data expected within a year.

This is particularly important now that the Trump Administration is looking to destroy the US’s Orbiting Carbon Observatory, the US’s only satellites able to provide high quality greenhouse gas measurements. Once again, this is a signal that European countries are willing to take a climate leadership role, sometimes. You know, when it fits them.

AI-ify the News

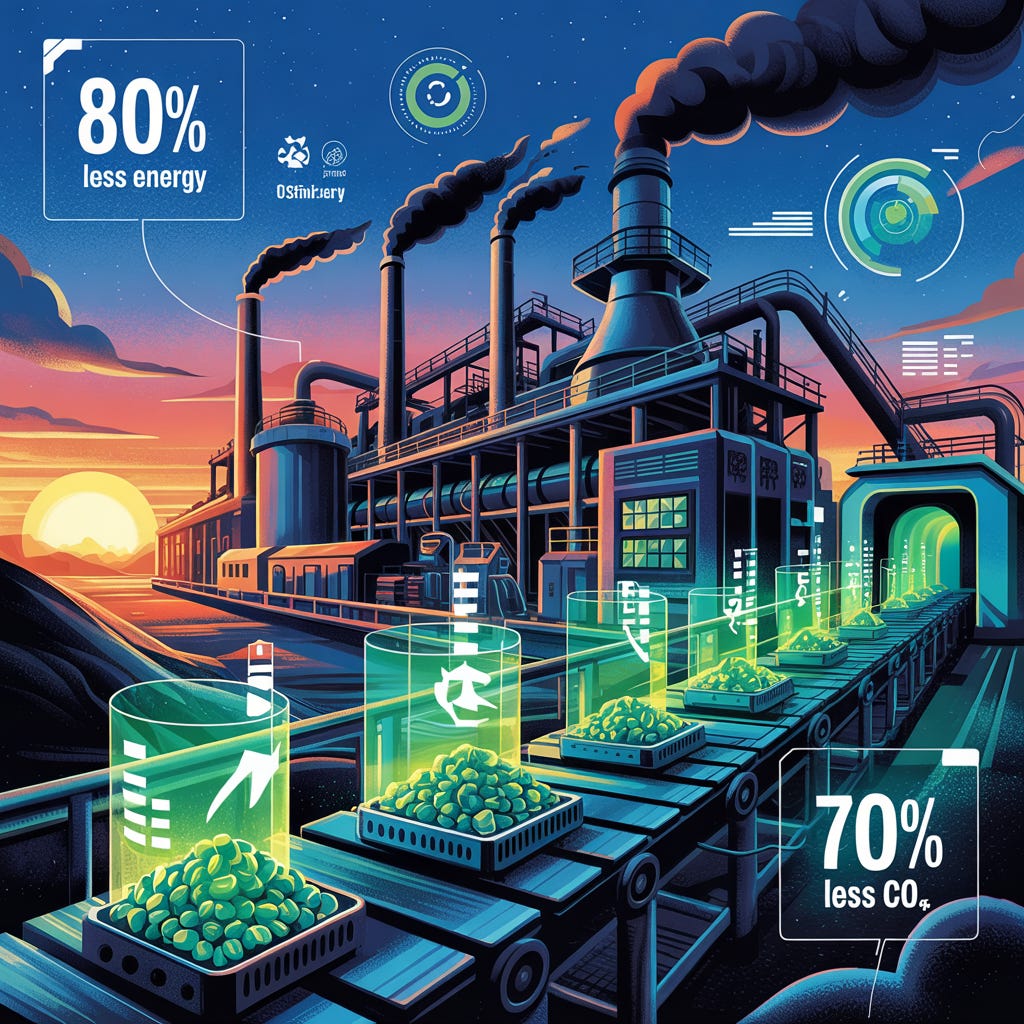

As always, here’s an AI-generated picture that should somehow summarize the news. Whether it’s successful or not is up to you to decide.

Binding Solutions

You run a steel manufacturing operation. You heard about this “green steel” and it sounds great. Who wouldn’t want to help reduce the 7% of global CO2 emissions you and your magnate friends are responsible for? But easier said than done. You found out there’s a price to be paid, and your razor-thin margins can’t let you rebuild your blast furnace.

Lucky for you, Binding Solutions has your back.

Binding Solutions is doing the impossible: making high-quality iron ore pellets without the massive energy-intensive induration process. Their Cold Agglomerated Pellet (CAP) technology works at temperatures below 150°C instead of the usual 1,300°C. Same quality pellets, a fraction of the energy, and you… well, you don’t have to replace the entire darn blast furnace.

Binding Solutions helps you get more value (and less carbon) out of their iron ore by providing...

Iron ore pellets that are just as tough as the old-school ones, but made with 80% less energy

Up to 70% fewer CO₂ emissions during pellet production—without sacrificing quality or output

A process that slashes capital costs for new pelletizing facilities by 86% (your finance guy will thank you)

A drop-in solution: you can swap in up to 8% of these pellets in your existing blast furnaces, no expensive retrofits required

To me, Binding Solutions provides a timely solution for a pressing need of the global steel industry during a time of reconfiguration. As firms respond to pressures to decarbonize and shifting consumer sentiments, they are in need for affordable and potent solutions. Binding Solutions offers a cost-effective approach that makes calculus much easier. My bet is that the reconfiguration of the steel industry will happen one way or another, and existing steel operators run the risk of making way for upstarts that won’t have legacy capital equipment to consider. Binding Solutions gives them a chance.

That’s it for this edition of News Reconfigured.

Stay tuned for my new hot take on Tuesday, and see you soon next week!

…oh, and don’t forget to subscribe - it would mean a lot! 🔽